Retirement Planning

Do I need to plan for my retirement?

Pensions can be confusing but here at Lifespan Financial Services Ltd we believe it shouldn’t be. We provide our clients with retirement planning and advice that’s transparent and easy to understand.

- If you are 56 or under on 1st January 2016, you will be 68 before you are eligible to claim the State Pension (contributory). That’s potentially a three year gap in retirement income.

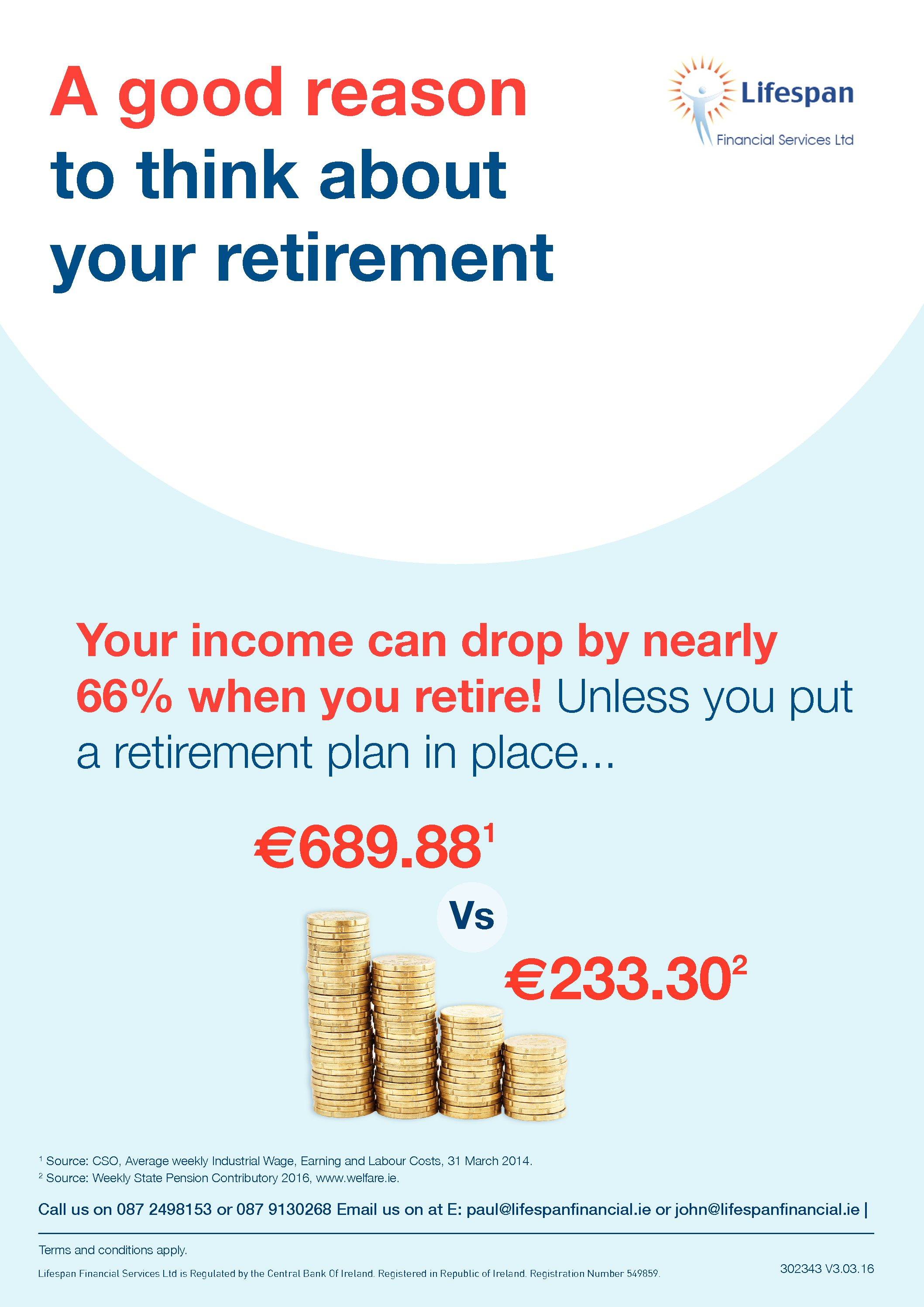

- Unless you put a retirement plan in place, your income could drop by nearly 66% when you retire! The State contributory Pension is €12,132 but the average industrial wage is €35,874. You need to save for your retirement to avoid a big drop in income.

- A longer life means a longer retirement that you need to fund for. As average life expectancy increases, so does the amount of time we spend in retirement. Your retirement fund now needs to last longer.

Source: Weekly State Pension Contributory 2016, www.welfare.ie.

Source: CSO, Average weekly Industrial Wage, Earning & Labour Costs, 31st March 2014.

Source: CSO, Women and Men in Ireland 2013.

Book a Consultation

Please fill in your details below and the relevant department will contact you within 24 hours.